Small Business Banker

Aventura, Florida

As a member of the Business & Personal Banking team, you’ll partner with our clients as a trusted ally, to accompany them every step of the way, thriving with them as they build their dreams. In your role, you will build trusted and dependable relationships that fuel bold achievement for our clients. We are the transformative allies in their journeys. At City National Bank of Florida, we keep true to our intimate roots, but are unbounded in our aspirations. Say yes to possibility.

- Job Type: Full Time

- Workplace Policy: On-Site

- Travel: Minimal (if any)

Success Profile

- Consultative

- Entrepreneurial

- Relationship Expert

- Results-Driven

- Self-Starter

- Team Player

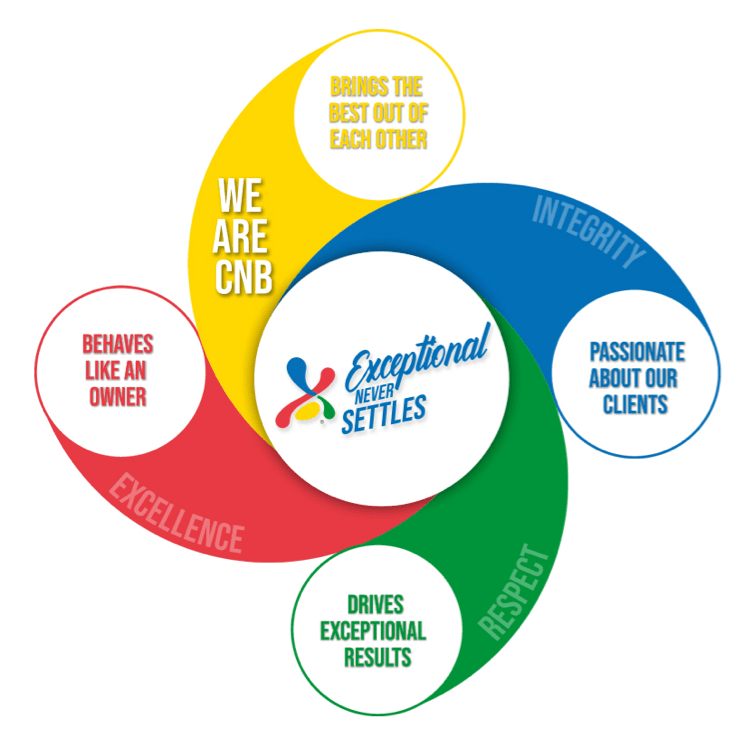

Culture

Our entrepreneurial, win-together team thinks boldly, looks to and learns from each other, and is focused on creating big client successes that lead to big career growth.

“What I love most about working for City National Bank is the sense of community and impact it provides. Small businesses are the backbone of our economy, and being able to support and empower them is truly fulfilling. It's incredible to see the positive impact that banking can have on their communities, and I'm grateful to be a part of that.”

Banker, City National Bank of Florida

Small Business Banker

Serves small businesses with annual revenues from $250k to $5 million providing comprehensive financial solutions to our clients. Responsible for meeting the needs and expectations of customers by servicing, promoting and selling the Bank’s products and services, increasing deposits and fee income, reducing expenses, maintaining and expanding superior client relations, and consistently meeting or exceeding assigned individual or team sales goals. Services all customer account needs. Coordinates with the Bank Manager in preparing required reports and performs other functions as required for the sound operations of the bank. Cross trained in all paying, receiving and collection functions including cash handling. Accurately processes transactions, adheres to strict security measures balancing procedures. May provide loan support functions in certain offices.

Principal Duties & Responsibilities:

Consistently meets and/or exceeds assigned individual, team and revenue goals within a designated market and gaining complete knowledge of the business and personal financial needs of assigned clients.

Proactively seek ways to develop and expand client relationships in order to contribute towards the Bank’s success.

Develops and maintains a prospect list of potential customers. Participates in networking, outside sales efforts and cold calling as appropriate.

Acts as the face of the Bank in the community and takes appropriate leadership roles as available.

Responsible for growing the profitability of the small business client base.

Develops deposit and loan relationships.

Prospects and acquires new priority small businesses.

Retains and deepens existing relationships.

Responsible for new acquisition activities.

Analyzes client’s financial conditions and recommends financial solutions to best meet client’s business and personal needs.

Well versed in all Bank products and services to ensure relationship building opportunities and maintains strong relationships with current clients.

Identifies client needs and will coordinate/refer to other lines of business as needed including meeting referral goal expectations.

Opens and processes all types of accounts, products and/or services for clients after consulting with them on their specific needs.

Makes overdraft decisions on a daily basis, pay/return decisions using independent judgment within authority limits.

Handles general client inquiries. Reconciles client statements, confers with operations personnel regarding discrepancies in balances and other problems and works toward the proper maintenance of the account files.

Services all customer account needs: accepts deposits, cashes checks within limits as specified by bank policy, processes withdrawals, sell travelers checks, and cashier checks. Accepts loan payments, etc.

Works closely with all lines of business and other departments to deliver an integrated and seamless experience for clients.

Maintains strong product knowledge and knowledge of the marketplace. Works with other bank employees on the approval of transactions necessary for the efficient operation of the bank.

Keeps abreast of changing business trends that impact the Personal and Business Banking area and translates those rends into business opportunities.

Well versed in all Bank products and services to ensure relationship building opportunities.

Ensures compliance with the Bank’s operational and security policies and procedures so as to ensure that maximum accounting integrity and security prevails at all times.

Completes all necessary G/L tickets and balances accurately.

Ensures that reports required by Senior Management are accurate and completed on time.

Responsible for opening and closing the banking center.

- 2 - 4 years work experience and proven outside sales experience in financial services or small business banking.

- Ability to demonstrate examples of improving specific businesses financial outcomes by interpreting financial statements and recommending specific levers to pull.

- Proven track record of prospecting new business, enhancing existing relationships and meeting or exceeding sales goals.

- Proven sales skills and client management experience.

- Must be able to assess and analyze financial conditions of clients and industry trends.

- Ability to understand and interpret financial statements and cash flow analysis.

- This position requires National Mortgage Licensing System (NMLS) registration under the terms of the S.A.F.E. Act of 2008 and Regulation Z. The Mortgage Loan Originator will be subject to the required registration process, which includes a criminal background and credit check. Failure to meet or maintain any of the NMLS registration requirements, including maintaining a satisfactory criminal and credit record, may result in a rescission of your offer or termination of employment.

- Bachelors degree in Business, Finance or Economics.

- Equal Opportunity Employer/Protected Veterans/Individuals with Disabilities.

- Please view Equal Employment Opportunity Posters provided by OFCCP here.

- The contractor will not discharge or in any other manner discriminate against employees or applicants because they have inquired about, discussed, or disclosed their own pay or the pay of another employee or applicant. However, employees who have access to the compensation information of other employees or applicants as a part of their essential job functions cannot disclose the pay of other employees or applicants to individuals who do not otherwise have access to compensation information, unless the disclosure is (a) in response to a formal complaint or charge, (b) in furtherance of an investigation, proceeding, hearing, or action, including an investigation conducted by the employer, or (c) consistent with the contractor's legal duty to furnish information. 41 CFR 60-1.35(c)

- Reasonable accommodation may be made to assist individuals with disabilities to complete the online application process. Please contact our Human Resources Department at 305-577-7680 or by e-mail at employment@citynational.com.

Community focus, global reach.

Our roots are in Florida’s communities, but our reach is far greater. Bci, our parent company, spans from Chile to China, connecting us to global resources and capabilities.

Learn More

Great Place To

Work® Certified™

Benefits

-

Medical

We are proud to offer you a choice of medical plans that provide comprehensive medical and prescription drug coverage. The plans also offer many resources and tools to help you maintain a healthy lifestyle.

-

401(k)/Retirement Plans

We don't just want you to have a great career, but a great life, so we provide a comprehensive 401(k) program that provides 100% match up to 5%.

-

Tuition Reimbursement

We offer you the opportunity to make your educational dreams a reality. We provide financial assistance for undergraduate and graduate studies.

-

Holidays

As if we don't have plenty of PTO, we also celebrate all national holidays. This perk just keeps on giving: see the list of holidays.

-

Awards & Recognition

We believe that employee engagement doesn't just happen, you have to make it happen, and we do. Here you will have very strong awards and recognition programs that celebrate the true you.

-

Flex Time

We are all-in on the office, but understand that working from home has some benefits, so, for some roles we offer the best of both worlds. We have a hybrid work schedule so you can too.