Business Market Leader

Miami, Florida

As a member of the Business & Personal Banking team, you’ll partner with our clients as a trusted ally, to accompany them every step of the way, thriving with them as they build their dreams. In your role, you will build trusted and dependable relationships that fuel bold achievement for our clients. We are the transformative allies in their journeys. At City National Bank of Florida, we keep true to our intimate roots, but are unbounded in our aspirations. Say yes to possibility.

- Job Type: Full Time

- Workplace Policy: On-Site

- Travel: Minimal (if any)

Success Profile

- Consultative

- Entrepreneurial

- Relationship Expert

- Results-Driven

- Self-Starter

- Team Player

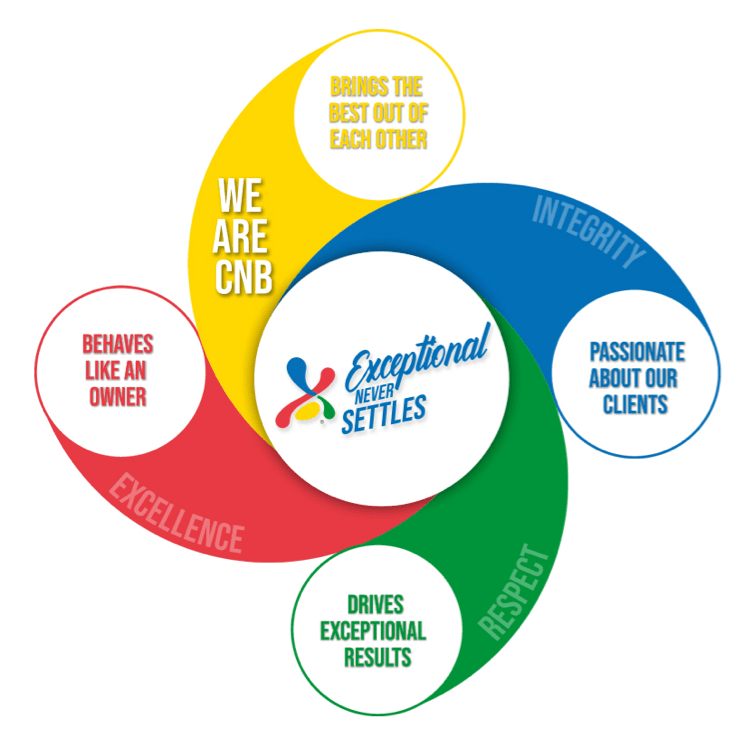

Culture

Our entrepreneurial, win-together team thinks boldly, looks to and learns from each other, and is focused on creating big client successes that lead to big career growth.

“What I love most about working for City National Bank is the sense of community and impact it provides. Small businesses are the backbone of our economy, and being able to support and empower them is truly fulfilling. It's incredible to see the positive impact that banking can have on their communities, and I'm grateful to be a part of that.”

Banker, City National Bank of Florida

Business Market Leader

The Business Market Leader coordinates at a senior level with the sales team to establish, build, and sustain business banking relationships with companies generally generating less than $20 million in gross sales. Responsible for driving success and growth within their assigned sales territory. As the primary relationship manager for the Bank, they oversee client interactions and are actively involved in the credit process, including Credit Underwriting, Portfolio Management and Review, Risk/Credit grading, and risk identification and management. Portfolio management responsibilities encompass servicing, covenant compliance, and collateral monitoring. The role includes setting high expectations, fostering workforce stability by attracting, developing, and retaining talent, and supporting the team through coaching while modeling the bank's core values. Additionally, the Business Market Leader plays an active role in their local banking center community and contributes to fulfilling the Bank's CRA (Community Reinvestment Act) requirements.

Principal Duties & Responsibilities:

Consistently meets and exceeds individual and/or team sales goals, including but not limited to deposits, loans, and other applicable metrics.

Independently expands existing relationships and solicits new business through client referrals and cold-calling efforts outside of the banking center to align with or exceed the Bank’s strategic goals.

Independently analyzes credit checks worthiness, and conducts preliminarily financial statement analysis against bank risk standards and applicable product requirement to preliminarily determine potential credit worthiness.

Provides leadership to a team of sales professionals, ensuring they meet or exceed established sales and revenue targets.

Collaborates closely with the team to generate, identify, qualify, and prioritize new prospects as well as nurture the existing book of business.

Regularly contacts the top 20 loan and deposit clients monthly via phone or in person to maintain relationships and identify cross-selling opportunities.

Conducts research on existing clients through various sources to uncover additional cross-selling opportunities.

Focuses on increasing core deposits and actively contributes to loan funding.

Develops sales proposals and strategies at an expert level.

Possesses comprehensive knowledge of the market, competitors, and maintains a strategic outlook for business growth.

Demonstrates expert-level understanding of all bank products and services.

Establishes, expands, and maintains referral sources.

Conducts thorough pre-call planning and prepares worksheets prior to joint client appointments.

Independently assesses and meets clients' financial needs by analyzing their financial profiles and relevant documentation such as tax returns, credit reports, personal financial statements, and debt schedules.

Documents the relationship management process.

Guides clients in analyzing financial issues and recommends suitable solutions.

Acts as a client advocate in securing appropriate credit and cross-selling products and services.

Evaluates business, management, industry, financial, and structural risks and documents assessments in credit approval documents.

Organizes and leads complex sales initiatives, including customized proposal generation.

Develops and maintains strong relationships with all partners.

Contributes actively to banking center success through participation in sales campaigns, banking center activities, and community organizations.

Structures and completes secured and unsecured business loans, ensuring compliance with policy and presenting deals to the Risk team.

Participates in all required branch meetings and weekly joint calls or prospecting sessions with Small Business Bankers, followed by coaching sessions and completion of required coaching forms.

Adheres to the requirements of the S.A.F.E. Act and follows procedures, including notifying Human Resources of any changes in current status.

- 5-7 years of bank business development experience.

- 2 + years of bank lending experience, which includes credit analysis.

Must be highly capable of meeting sales goals, independent activity in direct banking sales and credit support as well as maximizing cross-sell opportunities and relationship profitability.

Exceptional consulting skills; ability to probe, listen, clarify and present information to advance sales transactions, deepen relationships.

Demonstrated analytical skills and ability to assimilate complex financial and company operating information.

Professional presentation skills.

Strong working knowledge of credit structuring and processing; credit trained preferred.

Highly effective communication and influence skills.

Superior organizational skills.

Excellent business development skills.

Intermediate PC skills, knowledge of Microsoft Office software, and referral tracking programs.

- Bachelor's Degree in Business Administration or equivalent.

- Equal Opportunity Employer/Protected Veterans/Individuals with Disabilities.

- Please view Equal Employment Opportunity Posters provided by OFCCPhere.

- The contractor will not discharge or in any other manner discriminate against employees or applicants because they have inquired about, discussed, or disclosed their own pay or the pay of another employee or applicant. However, employees who have access to the compensation information of other employees or applicants as a part of their essential job functions cannot disclose the pay of other employees or applicants to individuals who do not otherwise have access to compensation information, unless the disclosure is (a) in response to a formal complaint or charge, (b) in furtherance of an investigation, proceeding, hearing, or action, including an investigation conducted by the employer, or (c) consistent with the contractor's legal duty to furnish information. 41 CFR 60-1.35(c)

- Reasonable accommodation may be made to assist individuals with disabilities to complete the online application process. Please contact our Human Resources Department at 305-577-7680 or by e-mail at employment@citynational.com.

Community focus, global reach.

Our roots are in Florida’s communities, but our reach is far greater. Bci, our parent company, spans from Chile to China, connecting us to global resources and capabilities.

Learn More

Great Place To

Work® Certified™

Benefits

-

Medical

We are proud to offer you a choice of medical plans that provide comprehensive medical and prescription drug coverage. The plans also offer many resources and tools to help you maintain a healthy lifestyle.

-

401(k)/Retirement Plans

We don't just want you to have a great career, but a great life, so we provide a comprehensive 401(k) program that provides 100% match up to 5%.

-

Tuition Reimbursement

We offer you the opportunity to make your educational dreams a reality. We provide financial assistance for undergraduate and graduate studies.

-

Holidays

As if we don't have plenty of PTO, we also celebrate all national holidays. This perk just keeps on giving: see the list of holidays.

-

Awards & Recognition

We believe that employee engagement doesn't just happen, you have to make it happen, and we do. Here you will have very strong awards and recognition programs that celebrate the true you.

-

Flex Time

We are all-in on the office, but understand that working from home has some benefits, so, for some roles we offer the best of both worlds. We have a hybrid work schedule so you can too.