International Client Acquisition Officer

Miami, Florida

As a member of the Business & Personal Banking team, you’ll partner with our clients as a trusted ally, to accompany them every step of the way, thriving with them as they build their dreams. In your role, you will build trusted and dependable relationships that fuel bold achievement for our clients. We are the transformative allies in their journeys. At City National Bank of Florida, we keep true to our intimate roots, but are unbounded in our aspirations. Say yes to possibility.

- Job Type: Full Time

- Workplace Policy: On-Site

- Travel: Minimal (if any)

Success Profile

- Consultative

- Entrepreneurial

- Relationship Expert

- Results-Driven

- Self-Starter

- Team Player

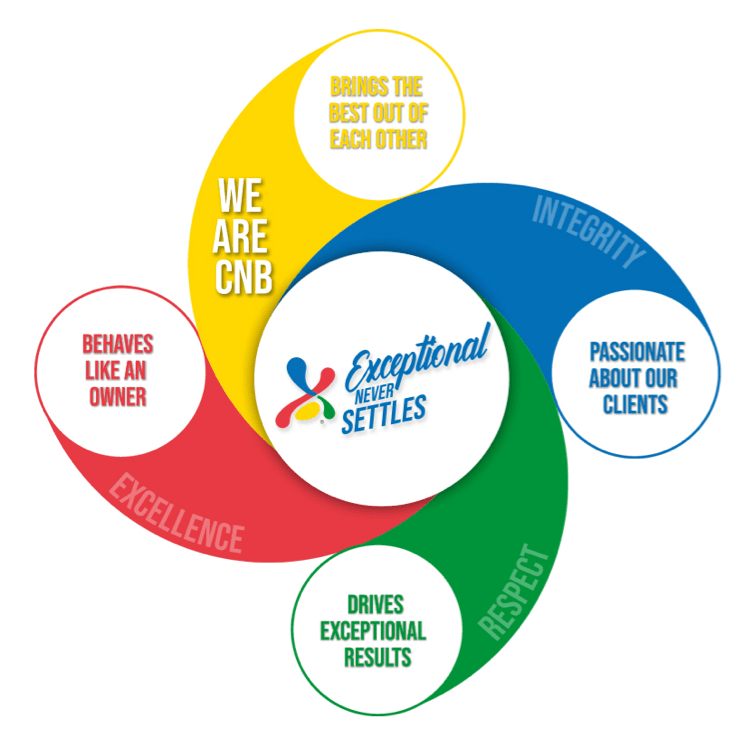

Culture

Our entrepreneurial, win-together team thinks boldly, looks to and learns from each other, and is focused on creating big client successes that lead to big career growth.

“What I love most about working for City National Bank is the sense of community and impact it provides. Small businesses are the backbone of our economy, and being able to support and empower them is truly fulfilling. It's incredible to see the positive impact that banking can have on their communities, and I'm grateful to be a part of that.”

Banker, City National Bank of Florida

International Client Acquisition Officer

The International Client Acquisition Officer oversees and drives strategic support to International Banking Relationship Managers (RMs). This role ensures that both new client onboarding and the management of existing clients within the International Private Banking (IPB) portfolio comply with all Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) policies. This position involves evaluating and improving the quality of Know Your Customer (KYC) processes and documentation, ensuring full adherence to compliance standards, and identifying and mitigating reputational risks to the bank. The role requires extensive knowledge, professional judgment, and the ability to independently plan and achieve objectives that address matters of critical significance to the bank's compliance and operational integrity.

Principal Duties & Responsibilities:

- Independently manages deadlines and ensures timely completion of responsibilities associated with compliance and client onboarding.

- Leads efforts to recruit and assess new Relationship Managers, focusing on their expertise in KYC and AML policies and documentation.

- Oversees workflows between the IPB unit and BSA departments to eliminate errors, prevent onboarding of prohibited risk clients, and streamline the onboarding process for Foreign National clients who meet the bank’s risk appetite.

- Serves as the primary liaison with the BSA and compliance departments, addressing all audit findings and ensuring alignment with regulatory standards.

- Ensures the timely completion of all unit alerts and cases, including the thorough documentation of files submitted to BSA.

- Oversees due diligence processes, particularly for onboarding high-risk clients and prospects, ensuring compliance with IPB guidelines.

- Reviews and pre-screens prospective clients, assessing documentation for adherence to BSA/AML requirements prior to submission.

- Conducts reviews to ensure that all client documentation and forms are meticulously imaged with precision, maintaining strict compliance standards. Global Radar reviews are thoroughly conducted, leaving no gaps in the evaluation process. This ensures the integrity of the bank’s compliance framework and operational reliability.

- Manages and resolves OFAC hits on wires, ACH transactions, and other related compliance matters as required.

- Reviews and ensures adherence to policies and procedures for specialized services such as bill pay, hold mail services, and other client-specific offerings, recommending improvements as necessary.

- Evaluates and ensures that operational processes within the IPB unit meet the bank’s required standards, implementing enhancements where necessary to align with regulatory and operational expectations.

- 5-7 years of experience in banking, with a focus on BSA/AML compliance, international banking, or risk management.

- 2-4 years demonstrated experience in managing client onboarding processes and ensuring regulatory compliance.

- Expertise in BSA/AML policies, KYC processes, and risk mitigation.

- Ability to handle numerous unrelated issues simultaneously and provide a sense of stability and guidance to the team related to BSA/AML matters.

- Strong leadership and decision-making abilities.

- High attention to detail and the ability to manage complex workflows.

- Excellent communication and organizational skills.

- Ability to exercise independent judgment and handle matters of significance effectively.

- Bachelor's Degree in Business Administration, Finance, Economics, or a related field preferred.

Community focus, global reach.

Our roots are in Florida’s communities, but our reach is far greater. Bci, our parent company, spans from Chile to China, connecting us to global resources and capabilities.

Learn More

Great Place To

Work® Certified™

Benefits

-

Medical

We are proud to offer you a choice of medical plans that provide comprehensive medical and prescription drug coverage. The plans also offer many resources and tools to help you maintain a healthy lifestyle.

-

401(k)/Retirement Plans

We don't just want you to have a great career, but a great life, so we provide a comprehensive 401(k) program that provides 100% match up to 5%.

-

Tuition Reimbursement

We offer you the opportunity to make your educational dreams a reality. We provide financial assistance for undergraduate and graduate studies.

-

Holidays

As if we don't have plenty of PTO, we also celebrate all national holidays. This perk just keeps on giving: see the list of holidays.

-

Awards & Recognition

We believe that employee engagement doesn't just happen, you have to make it happen, and we do. Here you will have very strong awards and recognition programs that celebrate the true you.

-

Flex Time

We are all-in on the office, but understand that working from home has some benefits, so, for some roles we offer the best of both worlds. We have a hybrid work schedule so you can too.