Market Team Leader

Miami, Florida

As a member of the Business & Personal Banking team, you’ll partner with our clients as a trusted ally, to accompany them every step of the way, thriving with them as they build their dreams. In your role, you will build trusted and dependable relationships that fuel bold achievement for our clients. We are the transformative allies in their journeys. At City National Bank of Florida, we keep true to our intimate roots, but are unbounded in our aspirations. Say yes to possibility.

- Job Type: Full Time

- Workplace Policy: On-Site

- Travel: Minimal (if any)

Success Profile

- Team player

- Results-driven owner

- Passionate client advisor

- Knowledge and expertise

- Relationship expert

- Multi-tasker

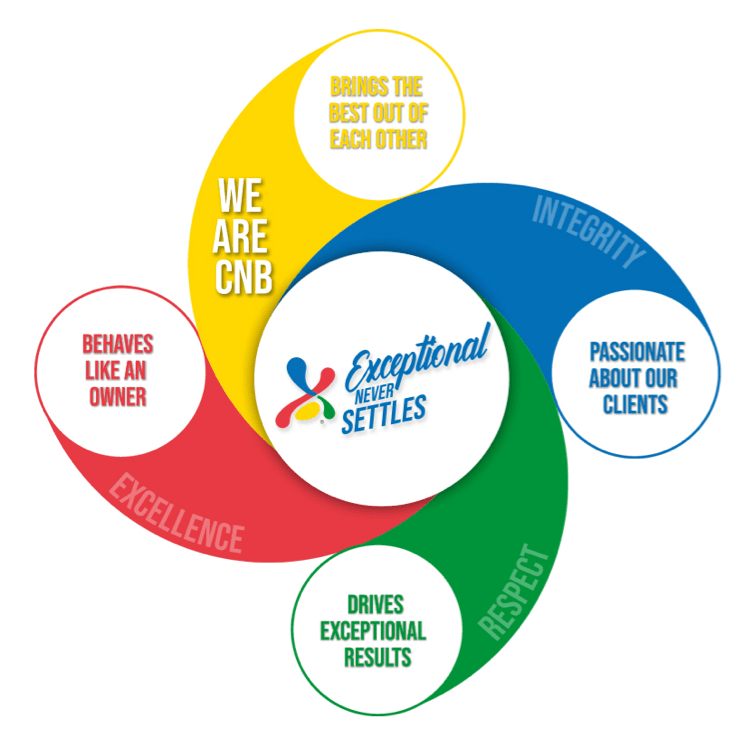

Culture

Our entrepreneurial, win-together team thinks boldly, looks to and learns from each other, and is focused on creating big client successes that lead to big career growth.

“What I love most about working for City National Bank is the sense of community and impact it provides. Small businesses are the backbone of our economy, and being able to support and empower them is truly fulfilling. It's incredible to see the positive impact that banking can have on their communities, and I'm grateful to be a part of that.”

Banker, City National Bank of Florida

Market Team Leader

The Market Team Leader is responsible for overseeing the day-to-day operations of the banking center while supporting the execution of sales initiatives and achievement of performance goals. This role actively engages with branch staff to acquire new clients, deepen existing relationships, and promote a high standard of client service.

The Market Team Leader ensures the banking center operates efficiently and in compliance with internal policies, procedures, and regulatory requirements. The role supervises one employee and is cross-trained in all areas of client service, including but not limited to cash handling, account openings, wire transfers, and general platform support.

In addition to overseeing daily banking center functions, the Market Team Leader helps drive sales activity, maintains operational accuracy, and ensures adherence to security protocols. This role may assist with training, provide functional guidance to team members, and contribute to fostering a positive client and employee experience.

Principal Duties and Responsibilities:

- Supports the execution of banking center sales strategies to drive deposit and loan growth, focusing on client retention and identifying new business opportunities.

- Consistently meets and strives to exceed individual and team sales goals, including deposits, loans, and referral metrics.

- Collaborates with Small Business Bankers (SBBs) and internal partners to identify and promote referral opportunities across business lines.

- Conducts outbound service calls using a consultative approach; addresses client objections and facilitates appropriate referrals, ensuring satisfaction and follow-up.

- Assists with the timely resolution of financial ticklers in accordance with Bank policies.

- Reviews and discusses the Banking Center’s Statement of Condition with leadership to support analysis of deposit and loan performance.

- Provides peer coaching and guidance to support referral performance and service effectiveness.

- Coordinates and assists with lead-scrubbing efforts, helping ensure accuracy of prospect data.

- Participates in client relationship-building activities, including follow-ups and check-ins with Tier 1 clients.

- Assists in developing business through relationships with Centers of Influence (e.g., CPAs, attorneys), as directed.

- Maintains a targeted prospect list and participates in networking, community outreach, and calling efforts.

- Represents the banking center at community events and supports the Bank’s public image and presence.

- Performs account opening, maintenance, and closing tasks, ensuring accuracy and compliance.

- Documents client activity and referral interactions in Elevate and ensures appropriate hand-offs.

- Adjusts staff positioning throughout the day to support client traffic and workflow needs.

- Processes and approves routine operational transactions, such as checks and wires, within assigned authority levels.

- Manages cash operations in coordination with UB Senior, including coin/currency ordering and shipment handling.

- Participates in ATM balancing, vault operations, and TCR reconciliation.

- Reviews night depository and ATM envelopes to ensure proper processing and documentation.

- Supports teller line operations and ensures timely scanning of daily work via remote capture.

- Maintains documentation for branch keys and combinations in coordination with the Regulatory Operations Consultant (ROC).

- Ensures files and documentation are handled and stored securely and in accordance with policy.

- Serves as backup to Universal Banker and UB Senior roles as needed to maintain service continuity.

- Performs duties related to safe deposit box access, documentation, rent collection, and escheatment processes.

- Coordinates SBB sales schedules and participates in lead call activities.

- Maintains full cross-training in teller, platform, and operational tasks to support business needs.

- Supports the implementation of client service excellence initiatives and operational standards.

- Reviews and escalates overdrafts for resolution or charge-off consideration per Bank guidelines.

- Completes routine client service requests, including account updates and product support.

- Maintains organized client records and ensures accuracy of data entered into the system.

- Demonstrates strong product knowledge, especially around Treasury Management services, to assist in identifying cross-sell opportunities.

- Initiates and verifies domestic and international wire transfers, following all policy and approval protocols.

- Works with ROC to resolve operational findings and ensure corrective measures are implemented.

- Performs quality reviews of wire transfers and related documentation for accuracy.

- Identifies client needs and provides recommendations for products and services as appropriate.

- Assists with overdraft recovery efforts and prepares accounts for potential charge-off.

- Submits required documentation for new accounts and business packages accurately and promptly.

- Verifies that system access and user roles are properly aligned with duties.

- Participates in quarterly check-ins and supports performance tracking activities.

- Follows risk management, fraud prevention, and loss mitigation procedures.

- Adheres to compliance requirements for account opening, regulatory testing (e.g., Reg CC, CIP, NRA), and related documentation.

- Participates in business continuity planning exercises and contributes to loss investigations when applicable.

- Completes dual control responsibilities for branch opening and closing as assigned.

- Assists in investigating operational losses and supports resolution activities.

- Reviews and submits timecards and time-related changes for accuracy, as applicable.

- Provides real-time peer support and models expected client service and referral behavior.

- May assist in supporting multiple banking centers if directed by branch or market leadership.

- Maintains flexibility in scheduling, including availability for Saturdays and temporary reassignment.

- Meets the requirements of the S.A.F.E. Act and follows all applicable procedures, including notifying Human Resources of any status changes.

- Minimum 2 years of retail banking operational experience at a supervisory level. Required

Strong business acumen with strong sales ability and persuasiveness skills.

Proven ability to exceed goals and drive revenue growth.

Ability to effectively coach, develop, and hold team members accountable.

Excellent communication, problem-solving, and decision-making skills.

Well organized, detail-oriented, and able to manage multiple priorities in a fast-paced environment.

In-depth understanding of bank operations, compliance, and client service best practices.

Comfortable exercising sound judgment and discretion within authority limits.

- High School Diploma or GED equivalent.

- An equivalent combination of education and relevant professional experience may be considered in lieu of a degree.

- Equal Opportunity Employer/Protected Veterans/Individuals with Disabilities.

- Please view Equal Employment Opportunity Posters provided by OFCCPhere.

- The contractor will not discharge or in any other manner discriminate against employees or applicants because they have inquired about, discussed, or disclosed their own pay or the pay of another employee or applicant. However, employees who have access to the compensation information of other employees or applicants as a part of their essential job functions cannot disclose the pay of other employees or applicants to individuals who do not otherwise have access to compensation information, unless the disclosure is (a) in response to a formal complaint or charge, (b) in furtherance of an investigation, proceeding, hearing, or action, including an investigation conducted by the employer, or (c) consistent with the contractor's legal duty to furnish information. 41 CFR 60-1.35(c)

- Reasonable accommodation may be made to assist individuals with disabilities to complete the online application process. Please contact our Human Resources Department at 305-577-7680 or by e-mail at employment@citynational.com.

Community focus, global reach.

Our roots are in Florida’s communities, but our reach is far greater. Bci, our parent company, spans from Chile to China, connecting us to global resources and capabilities.

Learn More

Great Place To

Work® Certified™

Benefits

-

Medical

We are proud to offer you a choice of medical plans that provide comprehensive medical and prescription drug coverage. The plans also offer many resources and tools to help you maintain a healthy lifestyle.

-

401(k)/Retirement Plans

We don't just want you to have a great career, but a great life, so we provide a comprehensive 401(k) program that provides 100% match up to 5%.

-

Tuition Reimbursement

We offer you the opportunity to make your educational dreams a reality. We provide financial assistance for undergraduate and graduate studies.

-

Holidays

As if we don't have plenty of PTO, we also celebrate all national holidays. This perk just keeps on giving: see the list of holidays.

-

Awards & Recognition

We believe that employee engagement doesn't just happen, you have to make it happen, and we do. Here you will have very strong awards and recognition programs that celebrate the true you.

-

Flex Time

We are all-in on the office, but understand that working from home has some benefits, so, for some roles we offer the best of both worlds. We have a hybrid work schedule so you can too.