Private Banking Officer Senior

Miami, Florida

City National Bank of Florida Relationship Managers work with a wide range of clients, from individual investors and small business owners to large corporations and institutional investors. The Relationship Manager must be knowledgeable about the financial products and services available to their clients and be able to provide expert advice and guidance on everything from investment strategies to risk management. In addition to providing financial advice and support, Relationship Managers are also responsible for building and maintaining trust with their clients. They must be skilled at communication and interpersonal relations and be able to establish strong and positive relationships with clients based on trust, respect, and mutual understanding.

- Job Type: Full Time

- Workplace Policy: Hybrid

- Travel: Minimal (if any)

Success Profile

- Relationship Expert

- Problem Solver

- Multi-tasker

- Confident

- Strategic

- Results Driven

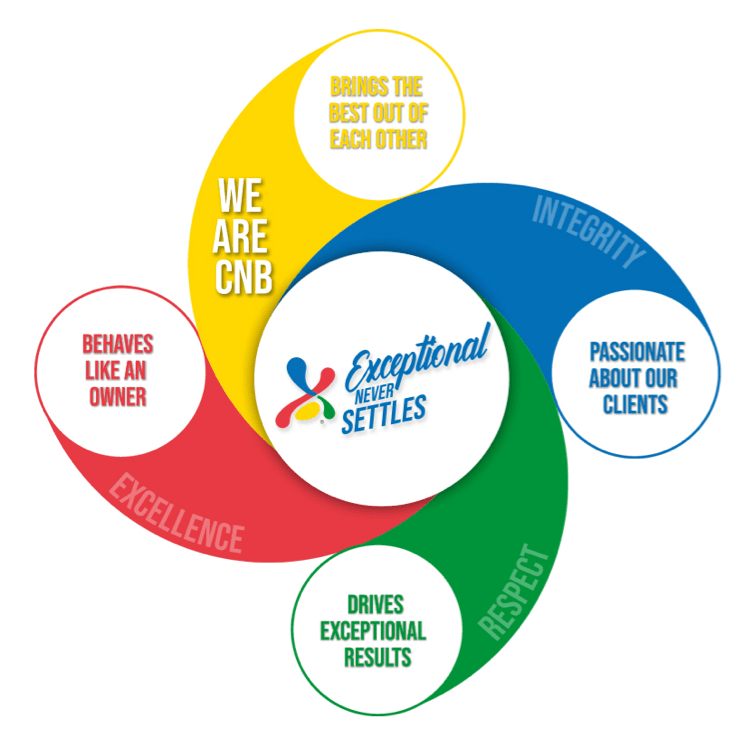

Culture

Our entrepreneurial, win-together team thinks boldly, looks to and learns from each other, and is focused on creating big client successes that lead to big career growth.

“As a Relationship Manager, I can confidently say that this is one of the most rewarding and fulfilling careers out there. Building and maintaining strong relationships with clients is at the heart of this profession, which means that every day is different and presents new challenges to overcome. What I love most about being a Relationship Manager at CNB is the opportunity to help clients achieve their financial goals and realize their dreams, by creating creative solutions. Whether it's securing a loan for a new business venture, providing financial advice to help clients manage their finances better, or connecting them with resources and support, being a Relationship Manager is about being a partner in success.”

Highly Successful Relationship Manager, City National Bank of Florida

Private Banking Officer Senior

The Private Banking Officer Senior serves as relationship manager for a portfolio of high net worth individuals, including, but not limited to Attorneys, CPAs, Physicians and entrepreneurs. Meets and exceeds goals by developing new loans and depository business from prospects and existing clients. Cross-sells bank products, including but not limited to Treasury Management Services. The individual will structure, negotiate and close loan transactions while assuring that a deposit component is prevalent in every loan transaction and new relationship. Individual is expected to deliver the highest level of client service to the client base while responding to all client requests on a timely basis by providing prompt and efficient service. Responsible for the development of Private Client Group clientele through business development calling efforts, social functions and association memberships.

Principal Duties & Responsibilities:

Consistently meets and exceeds individual and/or team sales goals, including deposit, loans, and other applicable metrics.

Independently expands existing relationships and solicits new business through client referrals and cold calling efforts to meet or exceed the Bank’s strategic goals.

Independently analyzes creditworthiness, conducts preliminary financial statement analysis against bank risk standards, and assesses potential creditworthiness for applicable products.

Requires significant skills in marketing presentations, sales, and relationship building.

Maintains an active calling program with prospects, existing clients, and referral sources; participates in outside activities through business and civic organizations relevant to Private Banking.

Manages and develops loan and deposit account relationships; responds promptly and efficiently to all client requests.

Within established procedures and authority, recommends or makes significant decisions regarding overdrafts, wires, pricing, structuring for Loans, Treasury products, and client servicing.

Makes critical decisions related to loan risks, required documentation, negotiation terms based on market conditions, loan profitability, client relationships, and bank goals.

Reviews all new and renewal loan requests, actively participates in the underwriting process with the Risk Officer, ensuring adherence to credit policies.

Maintains portfolio quality, monitors past due loans, minimizes loan risks, and ensures compliance with loan terms; promptly identifies and reports potential issues to management.

Reviews account relationships regularly to identify client financial needs (e.g., Treasury Management Services) and cross-sells all bank products.

Collaborates with other bank units (Treasury Management, Client Services, Legal, Loan Operations) to ensure seamless service delivery.

Structures and negotiates complex loans, identifying critical credit issues and mitigating credit risks.

Collaborates with Audit, Loan Review departments, and regulators (e.g., OCC) as required.

Ensures all loans are properly documented and comply with credit approvals; resolves documentation exceptions promptly.

Maintains up-to-date product knowledge and market awareness.

Complies with the S.A.F.E. Act requirements and notifies Human Resources of any status changes promptly.

- 8-10 years lending experience, including significant experience in private banking, with a proven track record of managing high-net-worth clients and achieving business development goals.

Proficient in cultivating Private Client Group clientele through strategic business development calling, active participation in social functions, and leveraging association memberships to expand client base and enhance professional visibility.

Meets and exceeds goals by developing new loans and depository business from prospects and existing clients

Cross-sells bank products, including but not limited to Treasury Management Service.

Proficient in structuring, negotiating, and finalizing loan transactions, ensuring integration of a deposit component in each transaction and new client relationship.

Demonstrates exceptional client service skills by promptly responding to all client inquiries and requests with efficiency and professionalism.

Ensures the highest level of client satisfaction by anticipating needs and delivering tailored solutions during all stages of the loan process.

Manages multiple client relationships effectively, fostering trust and loyalty through clear communication and transparent transaction handling.

Adheres to strict timelines and service standards to provide seamless and reliable service to the client base.

Formal Credit training preferred.

- Bachelor's Degree in Business, Finance or related field.

- Equal Opportunity Employer/Protected Veterans/Individuals with Disabilities.

- Please view Equal Employment Opportunity Posters provided by OFCCPhere.

- The contractor will not discharge or in any other manner discriminate against employees or applicants because they have inquired about, discussed, or disclosed their own pay or the pay of another employee or applicant. However, employees who have access to the compensation information of other employees or applicants as a part of their essential job functions cannot disclose the pay of other employees or applicants to individuals who do not otherwise have access to compensation information, unless the disclosure is (a) in response to a formal complaint or charge, (b) in furtherance of an investigation, proceeding, hearing, or action, including an investigation conducted by the employer, or (c) consistent with the contractor's legal duty to furnish information. 41 CFR 60-1.35(c)

- Reasonable accommodation may be made to assist individuals with disabilities to complete the online application process. Please contact our Human Resources Department at 305-577-7680 or by e-mail at employment@citynational.com.

Community focus, global reach.

Our roots are in Florida’s communities, but our reach is far greater. Bci, our parent company, spans from Chile to China, connecting us to global resources and capabilities.

Learn More

Great Place To

Work® Certified™

Benefits

-

Medical

We are proud to offer you a choice of medical plans that provide comprehensive medical and prescription drug coverage. The plans also offer many resources and tools to help you maintain a healthy lifestyle.

-

401(k)/Retirement Plans

We don't just want you to have a great career, but a great life, so we provide a comprehensive 401(k) program that provides 100% match up to 5%.

-

Tuition Reimbursement

We offer you the opportunity to make your educational dreams a reality. We provide financial assistance for undergraduate and graduate studies.

-

Holidays

As if we don't have plenty of PTO, we also celebrate all national holidays. This perk just keeps on giving: see the list of holidays.

-

Awards & Recognition

We believe that employee engagement doesn't just happen, you have to make it happen, and we do. Here you will have very strong awards and recognition programs that celebrate the true you.

-

Flex Time

We are all-in on the office, but understand that working from home has some benefits, so, for some roles we offer the best of both worlds. We have a hybrid work schedule so you can too.