Small Business Banker Manager

Miami, Florida

As a member of the Business & Personal Banking team, you’ll partner with our clients as a trusted ally, to accompany them every step of the way, thriving with them as they build their dreams. In your role, you will build trusted and dependable relationships that fuel bold achievement for our clients. We are the transformative allies in their journeys. At City National Bank of Florida, we keep true to our intimate roots, but are unbounded in our aspirations. Say yes to possibility.

- Job Type: Full Time

- Workplace Policy: On-Site

- Travel: Minimal (if any)

Success Profile

- Consultative

- Entrepreneurial

- Relationship Expert

- Results-Driven

- Self-Starter

- Team Player

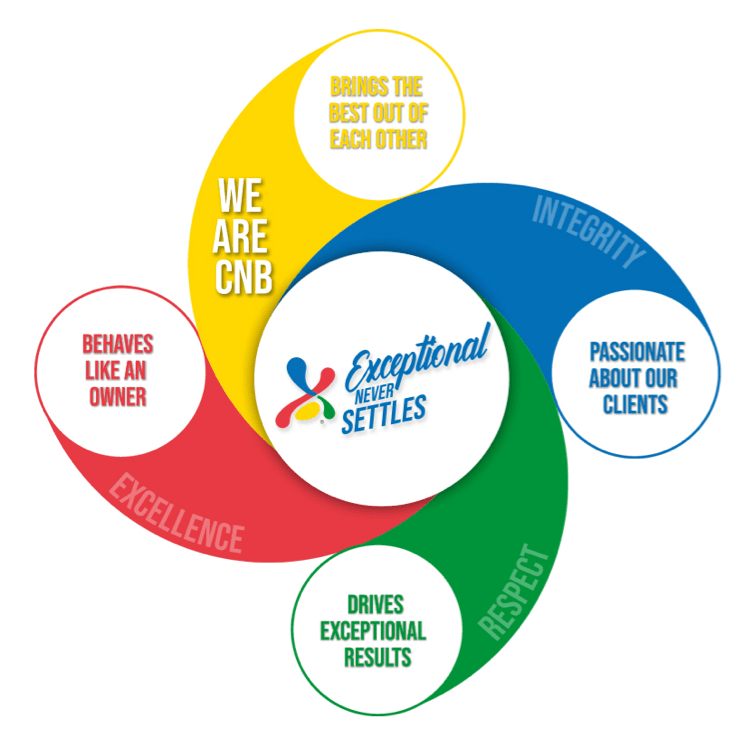

Culture

Our entrepreneurial, win-together team thinks boldly, looks to and learns from each other, and is focused on creating big client successes that lead to big career growth.

“What I love most about working for City National Bank is the sense of community and impact it provides. Small businesses are the backbone of our economy, and being able to support and empower them is truly fulfilling. It's incredible to see the positive impact that banking can have on their communities, and I'm grateful to be a part of that.”

Banker, City National Bank of Florida

Small Business Banker Manager

The Small Business Banker Manager (SBBM) is a management position responsible for overseeing the sales delivery model to achieve performance and growth objectives for City National Bank's Small Business segment. The SBBM directly manages and coaches a team of Small Business Bankers (SBBs), who provide comprehensive financial solutions to small businesses with annual revenues up to $10 million. The majority of the SBBM's time is spent in the field, working alongside the team, observing client interactions, and coaching on sales techniques to improve performance. The SBBM also runs weekly calling blitzes with the team to drive results. In addition to managing team performance, the SBBM implements sales management routines to acquire new small business relationships and deepen existing client connections. This leadership role involves actively coaching SBBs to meet aggressive sales goals.

The SBBM exercises discretion and independent judgment in overseeing team performance, shaping business strategies, and making decisions that affect client relationships. This position reports to the Regional Director.

Principal Duties & Responsibilities:

- Define and implement sales strategies and goals for Small Business Bankers (SBBs) to drive performance, maximize sales, and ensure alignment with the bank’s objectives.

- Directly manage, coach, and mentor a team of Small Business Bankers (SBBs), providing individualized coaching to develop sales skills, improve techniques, and achieve aggressive goals. Foster a collaborative environment that encourages open communication and self-evaluation, customizing coaching to meet the unique needs of each team member and supporting continuous self-improvement.

- Regularly evaluate team performance, track sales activities, and assess progress toward goals. Provide actionable insights to leadership, identifying areas for improvement and additional training or coaching needs.

- Facilitate ongoing sales training, including weekly role-plays, one-on-one coaching, and joint call shadowing to strengthen skills, reinforce best practices, and ensure team preparedness for client meetings and sales activities.

- Lead and coordinate sales events such as weekly calling blitzes, ensuring the team is well-prepared and aligned on sales strategies.

- Promote the use of sales tools, processes, technologies, and data-driven insights to increase operational efficiency and effectiveness across the sales team. Build awareness to ensure the team adopts these tools at scale while remaining adaptable to client needs.

- Collaborate with other teams (e.g., training, strategy, product) to ensure ongoing knowledge transfer, alignment with business goals, and access to necessary resources and updates.

- Guide SBBs through pre-call planning, provide feedback, and conduct post-call debriefings to ensure continuous improvement and effective performance.

- Track key sales metrics and activity levels, refining strategies and adjusting goals based on insights; report progress to the Regional Director and leadership to support decision-making.

- Identify areas for process improvement, propose changes, and implement adjustments to increase the effectiveness and efficiency of the sales team.

- Oversee daily and weekly sales activities, including assigned “Power Hours,” ensuring the team’s time is focused on meeting client needs and driving results.

- Maintain strong communication with senior leadership and key stakeholders to share team progress, identify challenges, and align on strategic initiatives.

- Provide constructive feedback to SBBs, focusing on growth and skill development, while fostering a learning environment that supports continuous improvement.

- Report learnings to other areas of the bank, including training, Strategy, and SE teams, and provide guidance on refining training programs as needed.

- Establish standards for SBB call blitzes, offering on-the-spot feedback and shadowing joint calls to reinforce best practices.

- Host A&D weekly calls to track progress, client contacts, share success stories, and discuss best practices, ensuring alignment across the team; invite and include partners in weekly meetings to maintain ongoing knowledge of products and services, ensuring the team remains up to date on offerings.

- Continuously improve existing processes and practices to drive sales team success, ensuring that strategies remain effective and adaptable to changing needs.

- Monitors the effectiveness of activities performed during assigned Power Hours, ensuring that time is used efficiently to drive sales and achieve performance goals.

- Communicate and interact effectively with decision-makers at all levels to ensure alignment with organizational goals and strategies.

- 2-4 years of experience in a Business Manager Lead (BML) or equivalent role.

- 2-4 years of leadership experience in banking, including coaching and managing teams.

- Minimum 2 years of strong scorecard performance or a proven track record of performance in a BML or equivalent role.

- In-depth knowledge of banking products and services, particularly those for small businesses, and how to effectively present and sell these solutions.

- Understanding of sales strategies and performance metrics, used to evaluate success in banking or financial services.

- Familiarity with financial regulations and industry standards relevant to small business banking.

- Exceptional written and verbal communication skills, with the ability to present effectively to diverse audiences and collaborate across various levels within the organization.

- Strong coaching and leadership skills, with the ability to motivate and guide a team, driving results in a matrixed environment.

- Problem-solving and critical thinking skills, demonstrating adaptability and resourcefulness in identifying challenges and implementing solutions.

- Time management and organizational skills, with the ability to prioritize tasks and ensure team efficiency in a fast-paced environment.

- Ability to assess and improve team performance, offering constructive feedback and supporting continuous skill development.

- Ability to analyze sales data and market trends, using insights to refine strategies and drive team performance.

- Ability to foster a collaborative team environment, encouraging open communication and alignment with business objectives.

- Ability to work effectively across a variety of levels within the organization, maintaining strong relationships with internal and external stakeholders.

- Required Bachelor's Degree in Business Administration, or a related field, or equivalent work experience.

- Equal Opportunity Employer/Protected Veterans/Individuals with Disabilities.

- Please view Equal Employment Opportunity Posters provided by OFCCPhere.

- The contractor will not discharge or in any other manner discriminate against employees or applicants because they have inquired about, discussed, or disclosed their own pay or the pay of another employee or applicant. However, employees who have access to the compensation information of other employees or applicants as a part of their essential job functions cannot disclose the pay of other employees or applicants to individuals who do not otherwise have access to compensation information, unless the disclosure is (a) in response to a formal complaint or charge, (b) in furtherance of an investigation, proceeding, hearing, or action, including an investigation conducted by the employer, or (c) consistent with the contractor's legal duty to furnish information. 41 CFR 60-1.35(c)

- Reasonable accommodation may be made to assist individuals with disabilities to complete the online application process. Please contact our Human Resources Department at 305-577-7680 or by e-mail at employment@citynational.com.

Community focus, global reach.

Our roots are in Florida’s communities, but our reach is far greater. Bci, our parent company, spans from Chile to China, connecting us to global resources and capabilities.

Learn More

Great Place To

Work® Certified™

Benefits

-

Medical

We are proud to offer you a choice of medical plans that provide comprehensive medical and prescription drug coverage. The plans also offer many resources and tools to help you maintain a healthy lifestyle.

-

401(k)/Retirement Plans

We don't just want you to have a great career, but a great life, so we provide a comprehensive 401(k) program that provides 100% match up to 5%.

-

Tuition Reimbursement

We offer you the opportunity to make your educational dreams a reality. We provide financial assistance for undergraduate and graduate studies.

-

Holidays

As if we don't have plenty of PTO, we also celebrate all national holidays. This perk just keeps on giving: see the list of holidays.

-

Awards & Recognition

We believe that employee engagement doesn't just happen, you have to make it happen, and we do. Here you will have very strong awards and recognition programs that celebrate the true you.

-

Flex Time

We are all-in on the office, but understand that working from home has some benefits, so, for some roles we offer the best of both worlds. We have a hybrid work schedule so you can too.