Regional Manager

Pompano Beach, Florida

As a member of the Business & Personal Banking team, you’ll partner with our clients as a trusted ally, to accompany them every step of the way, thriving with them as they build their dreams. In your role, you will build trusted and dependable relationships that fuel bold achievement for our clients. We are the transformative allies in their journeys. At City National Bank of Florida, we keep true to our intimate roots, but are unbounded in our aspirations. Say yes to possibility.

- Job Type: Full Time

- Workplace Policy: On-Site

- Travel: Minimal (if any)

Success Profile

- Team player

- Results-driven owner

- Passionate client advisor

- Knowledge and expertise

- Relationship expert

- Multi-tasker

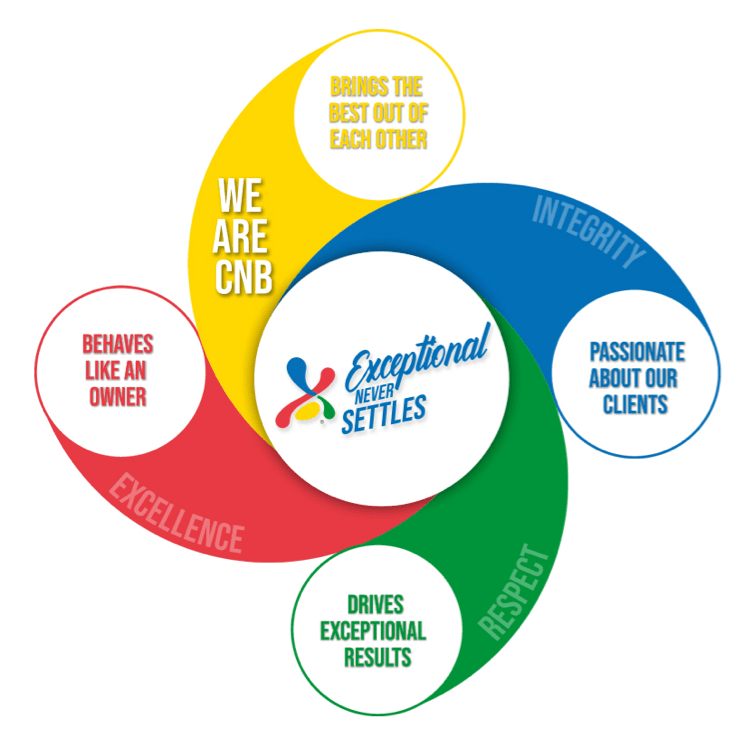

Culture

Our entrepreneurial, win-together team thinks boldly, looks to and learns from each other, and is focused on creating big client successes that lead to big career growth.

“What I love most about working for City National Bank is the sense of community and impact it provides. Small businesses are the backbone of our economy, and being able to support and empower them is truly fulfilling. It's incredible to see the positive impact that banking can have on their communities, and I'm grateful to be a part of that.”

Banker, City National Bank of Florida

Regional Manager

At a senior level, the role of the Regional Manager is responsible for the operational and service integrity of the Business Center. Executes Sales effectiveness and ensures all habits are adhered to in order to create efficiencies to retain and grow existing book. Acts as a coach to identify cross-sell opportunities and referrals from existing book of business Acts in a leadership capacity with the Business Center staff to develop, organize and execute on operational and client service experience. Sets high expectations, creates workforce stability by attracting, developing and retaining great talent.

Principal Duties & Responsibilities:

- Conducts comprehensive audits of all accounting records of the bank, including assets, liabilities, income, expenses, and related operations, following the audit program approved by the Audit Committee. This involves planning the audit, performing walk-throughs, assessing risks and controls, executing fieldwork in accordance with generally accepted auditing standards, evaluating the adequacy of internal controls, and preparing detailed working papers to document findings and support conclusions.

- Communicates audit findings and recommendations to senior management, stakeholders, and regulatory bodies, providing insights that drive improvements and ensure compliance with standards and regulations.

- Develops and discusses Corrective Action Plans during the audit fieldwork with appropriate bank management, addressing areas for improvement and ensuring corrective measures are effectively implemented.

- Drafts comprehensive audit reports detailing the scope, observations, management discussion items, enhancement opportunities, and Corrective Action Plans derived from the audit work performed, and engages with management at appropriate levels to discuss these findings.

- Collaborates with Bank Examiners and External Auditors during their examinations and audits, ensuring alignment with regulatory expectations and providing necessary information and insights.

- Develops and revises audit procedures and internal control questionnaires as required, adapting to changing regulatory requirements and operational needs.

- May focus on specialized areas requiring advanced knowledge and training, such as regulatory compliance, securities regulations, capital markets, and fiduciary trust activities, bringing expert insight to these complex functions.

- 5-7 years in bank internal auditing, external auditing of financial institutions, or regulatory examination, with a thorough understanding of banking practices, principles, and the inter-relationships between banking functions, capital markets, and wealth management.

Requires skills in fact-finding, analysis, problem-solving and decision making.

Strong regulatory requirements and risk framework knowledge and other relevant guidelines governing credit, liquidity, interest rate and fiduciary risks.

Advanced PC skills including working knowledge of TeamMate, Word and Excel

Experience in creating process documentation, developing audit plans, and performing audits.

Ability to plan, execute and evaluate audit test plans within a risk based audit methodology.

Strong written and verbal communication skills.

Knowledge of internal controls, financial terminology and bank documentation requirements.

Experience in assessing financial models and knowledge of testing effectiveness and recommending improvements.

Ability to communicate with various levels of staff and management.

Ability to manage scheduling and deadlines.

Licenses & Certifications:

- CIA, CPA, CISA, CIFRS, or other relevant audit or risk certification is required.

- Bachelor's Degree in Business Administration or related field required.

- Equal Opportunity Employer/Protected Veterans/Individuals with Disabilities.

- Please view Equal Employment Opportunity Posters provided by OFCCPhere.

- The contractor will not discharge or in any other manner discriminate against employees or applicants because they have inquired about, discussed, or disclosed their own pay or the pay of another employee or applicant. However, employees who have access to the compensation information of other employees or applicants as a part of their essential job functions cannot disclose the pay of other employees or applicants to individuals who do not otherwise have access to compensation information, unless the disclosure is (a) in response to a formal complaint or charge, (b) in furtherance of an investigation, proceeding, hearing, or action, including an investigation conducted by the employer, or (c) consistent with the contractor's legal duty to furnish information. 41 CFR 60-1.35(c)

- Reasonable accommodation may be made to assist individuals with disabilities to complete the online application process. Please contact our Human Resources Department at 305-577-7680 or by e-mail at employment@citynational.com.

Community focus, global reach.

Our roots are in Florida’s communities, but our reach is far greater. Bci, our parent company, spans from Chile to China, connecting us to global resources and capabilities.

Learn More

Great Place To

Work® Certified™

Benefits

-

Medical

We are proud to offer you a choice of medical plans that provide comprehensive medical and prescription drug coverage. The plans also offer many resources and tools to help you maintain a healthy lifestyle.

-

401(k)/Retirement Plans

We don't just want you to have a great career, but a great life, so we provide a comprehensive 401(k) program that provides 100% match up to 5%.

-

Tuition Reimbursement

We offer you the opportunity to make your educational dreams a reality. We provide financial assistance for undergraduate and graduate studies.

-

Holidays

As if we don't have plenty of PTO, we also celebrate all national holidays. This perk just keeps on giving: see the list of holidays.

-

Awards & Recognition

We believe that employee engagement doesn't just happen, you have to make it happen, and we do. Here you will have very strong awards and recognition programs that celebrate the true you.

-

Flex Time

We are all-in on the office, but understand that working from home has some benefits, so, for some roles we offer the best of both worlds. We have a hybrid work schedule so you can too.