Corporate Banking Relationship Manager

Tampa, Florida

City National Bank of Florida Relationship Managers work with a wide range of clients, from individual investors and small business owners to large corporations and institutional investors. The Relationship Manager must be knowledgeable about the financial products and services available to their clients and be able to provide expert advice and guidance on everything from investment strategies to risk management. In addition to providing financial advice and support, Relationship Managers are also responsible for building and maintaining trust with their clients. They must be skilled at communication and interpersonal relations and be able to establish strong and positive relationships with clients based on trust, respect, and mutual understanding.

- Job Type: Full Time

- Workplace Policy: Hybrid

- Travel: Minimal (if any)

Success Profile

- Team player

- Results-driven owner

- Passionate client advisor

- Knowledge and expertise

- Relationship expert

- Multi-tasker

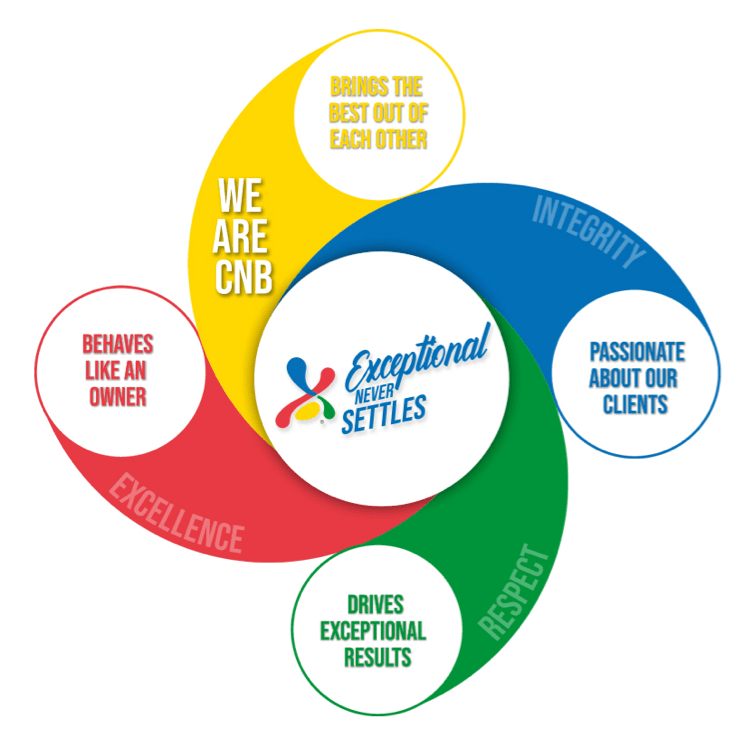

Culture

Our entrepreneurial, win-together team thinks boldly, looks to and learns from each other, and is focused on creating big client successes that lead to big career growth.

“As a Relationship Manager, I can confidently say that this is one of the most rewarding and fulfilling careers out there. Building and maintaining strong relationships with clients is at the heart of this profession, which means that every day is different and presents new challenges to overcome. What I love most about being a Relationship Manager at CNB is the opportunity to help clients achieve their financial goals and realize their dreams, by creating creative solutions. Whether it's securing a loan for a new business venture, providing financial advice to help clients manage their finances better, or connecting them with resources and support, being a Relationship Manager is about being a partner in success.”

Highly Successful Relationship Manager, City National Bank of Florida

Corporate Banking Relationship Manager

Acts as the primary advisor for a portfolio of Corporate Banking clients. Develops new business relationships and maintains important revenue-generating client relationships through new business development, relationship and portfolio management activities. Assesses the risks and impact from both the client's and bank's perspective, identifies opportunities to cross-sell related banking products and services and leads the development of an overall client relationship strategy.

Principal Duties & Responsibilities:

• Meets or exceeds individual sales and retention goals adhering to corporate, legal, and regulatory policies, guidelines, and requirements regarding compliance.

• Independently expands existing relationships and solicits new business through client referrals and cold calling efforts to meet or exceed the Bank’s strategic goals.

• Directs and manages the sales and service of financial services to Corporate Banking target market clients and prospects in accordance with loan quality guidelines, approval standards and production goals.

• Requires significant marketing presentation, sales and relationship building skills. Expands existing client relationships and actively seeks new clients via targeted prospecting.

• Responsible for meeting the broad needs of assigned clients by coordinating with assigned Risk Officers, Treasury Management Officers, Client Service Officers, and other Product Specialists. Partners with these specialists to meet the full range of client needs and ensures optimal response and service levels between departments.

• Under the parameters of procedures and individual authority, recommends and/or makes significant decisions regarding overdrafts, wires, pricing, structuring etc., for Loans, Treasury products, client servicing and other.

• If loan is an acceptable risk for the bank, negotiates the terms of the loan with the client based on the risk of the loan, current conditions in the financial markets, overall profitability of the loan and overall client relationship, and the current internal goals of the bank.

• In conjunction with Corporate Banking Manager, makes decisions of significant importance related to risk associated with the loan, documentation needed from client, negotiation of terms, etc.

• Independently reviews all new and renewal loan requests, coordinates and actively participates in the underwriting process together with appropriate Risk Officer, ensuring adherence to the Bank’s credit policies and criteria in loan decisions.

• Joint analysis with Corporate Banking Manager and risk partners, analyze, maintains portfolio quality, monitors past due loans, minimizes the risk of loan losses and keeps exceptions to a minimum.

• Ensures full compliance with loan terms. Promptly identifies potential issues and alerts management of any problems in the portfolio. Submits timely and accurate reports as required.

• Ensures that all loans are closed according to proper procedures and according to the specific conditions of the CAR working with the appropriate staff and the closing attorney.

- 2-4 years of Commercial Lending experience.

- Formal credit training by national or large regional bank.

- Strong understanding of the principles of accounting and finance.

- Strong marketing and analytical skills.

- Demonstrated problem-solving skills and interpersonal skills in demanding situations.

- Must be a self-starter and highly disciplined.

- Ability to work in a fast-paced environment with aggressive goals and objectives.

- Must be able to analyze financial conditions and industry trends.

- Excellent and effective presentation and communication skills, both verbal and written.

- Proficient with Excel, Word, Microsoft Office, and CRM Applications.

- Bachelor's Degree in Business or related field.

- Equal Opportunity Employer/Protected Veterans/Individuals with Disabilities.

- Please view Equal Employment Opportunity Posters provided by OFCCP here.

- The contractor will not discharge or in any other manner discriminate against employees or applicants because they have inquired about, discussed, or disclosed their own pay or the pay of another employee or applicant. However, employees who have access to the compensation information of other employees or applicants as a part of their essential job functions cannot disclose the pay of other employees or applicants to individuals who do not otherwise have access to compensation information, unless the disclosure is (a) in response to a formal complaint or charge, (b) in furtherance of an investigation, proceeding, hearing, or action, including an investigation conducted by the employer, or (c) consistent with the contractor's legal duty to furnish information. 41 CFR 60-1.35(c)

- Reasonable accommodation may be made to assist individuals with disabilities to complete the online application process. Please contact our Human Resources Department at 305-577-7680 or by e-mail at employment@citynational.com.

Community focus, global reach.

Our roots are in Florida’s communities, but our reach is far greater. Bci, our parent company, spans from Chile to China, connecting us to global resources and capabilities.

Learn More

Great Place To

Work® Certified™

Benefits

-

Medical

We are proud to offer you a choice of medical plans that provide comprehensive medical and prescription drug coverage. The plans also offer many resources and tools to help you maintain a healthy lifestyle.

-

401(k)/Retirement Plans

We don't just want you to have a great career, but a great life, so we provide a comprehensive 401(k) program that provides 100% match up to 5%.

-

Tuition Reimbursement

We offer you the opportunity to make your educational dreams a reality. We provide financial assistance for undergraduate and graduate studies.

-

Holidays

As if we don't have plenty of PTO, we also celebrate all national holidays. This perk just keeps on giving: see the list of holidays.

-

Awards & Recognition

We believe that employee engagement doesn't just happen, you have to make it happen, and we do. Here you will have very strong awards and recognition programs that celebrate the true you.

-

Flex Time

We are all-in on the office, but understand that working from home has some benefits, so, for some roles we offer the best of both worlds. We have a hybrid work schedule so you can too.